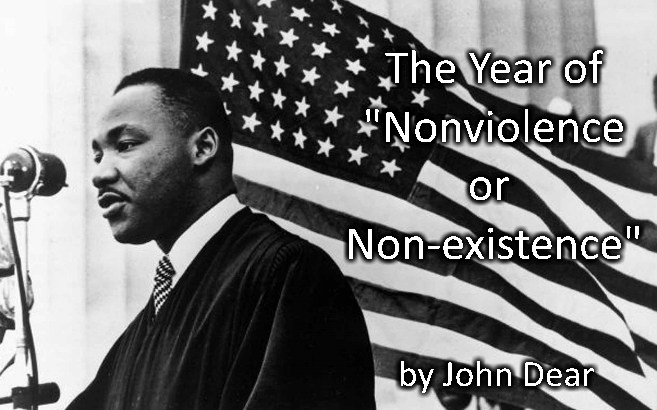

by John Dear

Book cover art courtesy Pace e Bene Press; paceebene.org

Editor’s Preface: This essay continues our series of responses to the Trump Era. Please see that category in the right sidebar. Please also consult the note at the end for further information and acknowledgments. JG

What a summer (2016)! Like everyone else, I’m trying to make some sense of it, and figure out a thoughtful response. We’ve suffered through the mainstream media’s non-stop broadcast of the dirty politics of hatred, scapegoating, and warmongering, particularly by Mr. Trump. We’ve undergone shootings by white police officers of unarmed African Americans, and even shootings of police, as well as massacres in Orlando and Nice, not to mention the daily U.S. massacres in Syria, Afghanistan, Iraq, and Yemen. We’ve endured the long hot days of catastrophic climate change with its wind and rain and heat and fire breathing down our necks. We seem to hit a new rock bottom of despair every week, only to sink to new lows the following week.

For many, there’s not much hope to be had. Sure, you can vote, but don’t expect anything more than the same ol’ same ol’ politics of violence, which means the politics of perpetual war, the politics of unparalleled corporate greed, the politics of death as a social methodology for the world. Democracy is fading. Fascism is growing. Behold, violence for the sheer sake of violence, the death of anonymous innocents around the globe, and millions of us who simply do not care.

“The worst time of my life,” my cousin Mary Anne said on the phone the other day. That was the sentiment of my friend and teacher, Father Daniel Berrigan, just before his death on April 30, 2016. The country and the world seem to sink beyond our worst imaginings. What should we do? We can give in, give up, back down, lie down and surrender; or we can vote, as some do every four years, for the lesser of two evils (and so make our peace with evil); and/or we can dig in for the long haul, and mobilize against the politics of violence on behalf of a new politics of nonviolence.

Read the rest of this article »